In the fast-paced world of finance and investments, understanding the asset trading schedule is crucial for traders and investors alike. Whether you are a seasoned trader or just starting out, being aware of the times when different assets are available for trading can significantly affect your strategy and outcomes. Asset Trading Schedule অ্যাসেট ট্রেডিংয়ের সময়সূচী In this comprehensive article, we will delve deep into what an asset trading schedule entails, its importance, and how you can strategically align your trading activities for maximum profitability.

What is an Asset Trading Schedule?

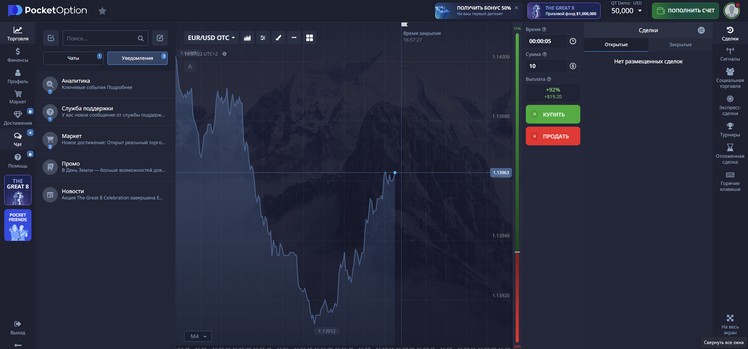

An asset trading schedule is essentially a timetable that outlines the specific times when various assets can be traded on different exchanges. This schedule is vital for traders as it shows when the market is open or closed for particular assets, helping them to plan their trades accordingly. These schedules can vary significantly across different financial instruments, including stocks, commodities, forex, and cryptocurrencies.

Why is the Asset Trading Schedule Important?

The importance of an asset trading schedule cannot be overstated. Here are several reasons why it is critical for traders:

- Market Availability: Knowing when markets are open allows traders to act swiftly when opportunities arise. For instance, Forex markets operate 24 hours a day, but knowing when liquidity is highest can lead to better trading results.

- Volatility Patterns: Certain assets may exhibit significant volatility during specific times of the trading day. Understanding these patterns can help traders make informed decisions.

- Economic Indicators: Key economic announcements often coincide with specific trading sessions. Being aware of these can assist traders in managing their positions better.

- Maximizing Trading Hours: By aligning trading activities with the asset trading schedule, traders can make the most out of their trading hours, thus increasing efficiency and potential profitability.

Understanding Different Markets

Each market operates on its unique schedule. Here’s a brief overview of the trading hours for some key asset classes:

Stock Markets

Stock markets often have fixed trading hours. For example, in the United States, the New York Stock Exchange (NYSE) operates from 9:30 AM to 4:00 PM EST on weekdays, with extended hours for pre-market and after-hours trading. European markets, such as the London Stock Exchange, have their own set trading hours.

Forex Market

The Forex market is unique because it operates globally 24 hours a day, five days a week. The market is divided into major trading sessions based on global financial centers, including the Sydney, Tokyo, London, and New York sessions. The overlap between these sessions often sees increased trading volume and volatility.

Cryptocurrency Markets

Unlike traditional financial markets, cryptocurrency markets are open 24/7. This constant availability allows traders to react to news and market movements at any time, making it essential to be aware of the latest developments in the crypto space.

How to Utilize the Asset Trading Schedule

Maximizing your trading success involves strategically utilizing the asset trading schedule. Here are some tips on how to do this effectively:

- Plan Ahead: Always check the trading hours for your assets in advance. This allows you to plan your trades and set alerts for potential trading opportunities.

- Set Notifications: Use trading platforms that allow you to set alerts for when your preferred assets are trading. This feature can keep you informed and help you act quickly on market movements.

- Analyze Price Movements: Study price movements during different trading sessions. Understanding when an asset typically moves can provide insights into potential entry and exit points.

- Stay Updated: Economic calendars and news feeds can provide information on when key announcements will occur and the assets that may be affected.

Conclusion

In conclusion, the asset trading schedule is a fundamental aspect of trading that every trader should comprehend. By understanding when different markets open and close, traders can better position themselves to take advantage of market movements and increase their chances of success. Always stay updated, plan your trades carefully, and align your trading activities with the asset trading schedule to maximize your profits in the dynamic and often unpredictable world of asset trading.